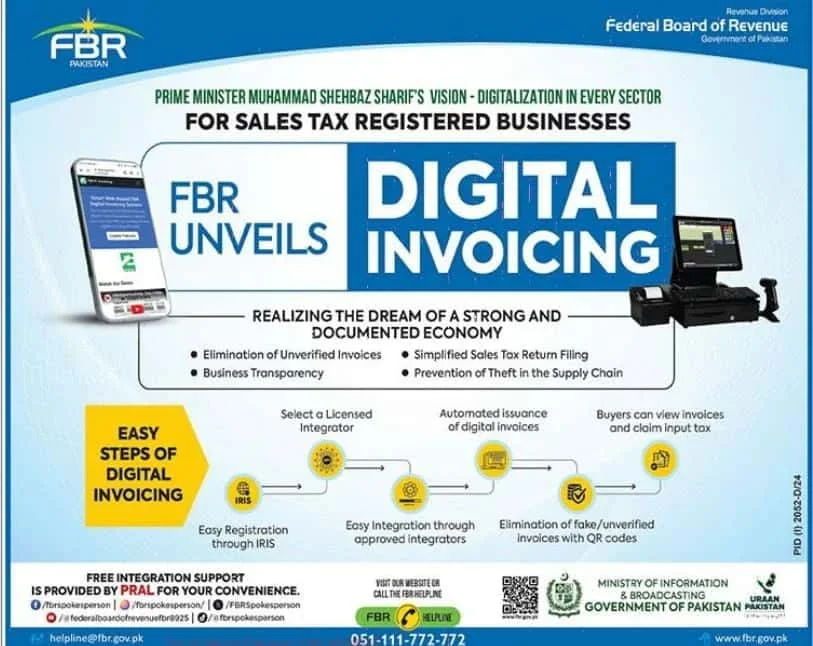

Complete Guide to FBR Digital Invoicing 2025 Pakistan has been struggling for years with issues like tax evasion, undocumented businesses, and lack of transparency in trade. To address these problems, the Complete Guide to Complete Guide to FBR Digital Invoicing has introduced a Digital Invoicing System for sales tax registered businesses. This new system is part of Prime Minister Shehbaz Sharif’s vision of digitalization in every sector of the economy.

Digital invoicing is a modern way of issuing invoices using approved software. It replaces the old manual system where businesses used paper-based invoices that were often unverified or fake. The new system ensures that every transaction is recorded, transparent, and available to both Complete Guide to FBR Digital Invoicing and buyers.

This article will explain what digital invoicing is, why it is important, how it works, its benefits, challenges, and what it means for businesses and the economy of Pakistan.

What is Digital Invoicing?

Digital invoicing is the process of creating and managing invoices electronically instead of on paper. Under the Complete Guide to FBR Digital Invoicing:

Businesses registered for sales tax will issue invoices using approved software.

Each invoice will carry a unique QR code.

Buyers can scan the QR code to verify the invoice and claim input tax.

The invoice data will automatically be shared with FBR through its system.

In simple words, it is a smart and secure way of handling sales records where nothing can be hidden or faked.

Why is Complete Guide to Complete Guide to FBR Digital Invoicing 2025?

For years, Pakistan’s tax system has faced many issues:

Unverified invoices – Many businesses used fake or duplicate invoices to avoid paying taxes.

Tax evasion – Billions of rupees were lost every year because of under-reporting or non-reporting of sales.

Lack of transparency – Buyers and sellers had no easy way to verify whether an invoice was real or not.

Complex sales tax filing – Businesses found it difficult to file correct returns because of errors in invoices.

Theft in supply chain – Goods were often smuggled or sold without documentation.

By introducing digital invoicing, the government aims to build a documented economy, improve tax collection, and make business processes easier and more transparent.

Key Features of Complete Guide to FBR Digital Invoicing 2025:

According to the FBR, the new system offers:

Elimination of unverified invoices – Every invoice will be verified through FBR’s system.

Business transparency – Buyers and sellers will have a clear record of sales.

Simplified sales tax return filing – Since all invoices are digital, tax returns will be automatically linked with FBR records.

Prevention of theft in supply chain – Fake invoices and undocumented sales will be eliminated.

How Does the System Work Complete Guide to FBR Digital Invoicing?

The process of digital invoicing is very simple and consists of five easy steps:

Easy Registration through IRIS

Businesses must first register on IRIS, FBR’s online tax portal.

Registration ensures that only sales tax registered businesses can issue digital invoices.

Select a Licensed Integrator

Businesses need to choose a licensed software provider (integrator) approved by FBR.

This software will be used to issue invoices.

Easy Integration through Approved Integrators

The integrator connects the business billing system with FBR’s central system.

This makes sure all invoices are automatically uploaded to FBR.

Automated Issuance of Digital Invoices

When a sale is made, the invoice is generated digitally.

It carries a QR code that buyers can scan to check its authenticity.

Verification by Buyers

Buyers can view and verify invoices by scanning the QR code.

They can also claim input tax credit using verified invoices.

This process makes invoicing quick, safe, and transparent.

Benefits of Digital Invoicing Complete Guide to FBR Digital Invoicing:

For Businesses Complete Guide to FBR Digital Invoicing

Less paperwork: No need to keep piles of paper invoices.

Error-free record keeping: Everything is automated, reducing mistakes.

Easier tax filing: Since all data is connected to FBR, filing returns becomes simpler.

Increased credibility: Businesses using digital invoicing will be seen as trustworthy.

For Buyers

Transparency: Buyers can check if the invoice is genuine by scanning the QR code.

Protection: No risk of fake invoices being issued.

Tax claim: Buyers can easily claim input tax using verified invoices.

For the Government and Economy

Better tax collection: No more hiding of sales or fake invoices.

Reduced corruption: The system leaves less room for manipulation.

Documented economy: A stronger economy where transactions are transparent.

Growth of digital economy: Encourages use of technology in business operations.

Challenges in Implementation

While digital invoicing is a positive step, there are also some challenges:

- Awareness – Many small businesses may not know how to use digital systems.

- Cost – Buying licensed software or hiring integrators may be costly for some.

- Technical issues – Businesses in rural areas may face problems with internet and connectivity.

- Resistance to change – Some traders may resist because they are used to manual invoicing.

- Training – Business staff will need training to adapt to the new system.

Role of PRAL in Integration Support

The image mentions that PRAL (Pakistan Revenue Automation Ltd.) will provide free integration support for businesses. This means businesses will not be left alone to figure things out. Instead, they will get help in connecting their billing system with Complete Guide to FBR Digital Invoicing.

The Bigger Picture: Moving Towards a Documented Economy

Digital invoicing is not just about technology – it is about building a stronger and fairer economy. For decades, Pakistan’s economy has suffered because of undocumented transactions, tax evasion, and lack of trust. With digital invoicing:

Every sale will be recorded.

Tax evaders will find it hard to hide.

Businesses will operate more transparently.

Government revenue will increase, which can be spent on public services.

This is why the system is being called a “dream of a strong and documented economy.”

Application Process for FBR Digital Invoicing

Register on IRIS

Sign up or log in to IRIS (FBR’s online system) using your NTN and password.

Check Sales Tax Registration

Make sure your business is already registered for sales tax.

Only registered businesses can use digital invoicing.

Select a Licensed Integrator

Choose an FBR-approved software provider (Integrator).

This integrator will connect your billing system to FBR.

Integrate Your Billing System

With the help of the integrator or PRAL (Pakistan Revenue Automation Ltd.), link your billing software with FBR’s system.

Start Issuing Digital Invoices

After setup, create invoices through the system.

Each invoice will include a QR code.

Invoice Verification

Customers can scan the QR code to check if the invoice is genuine.

Verified invoices allow buyers to claim input tax credit.

Complete Guide to FBR Digital Invoicing 2025 Advertisement: